n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

To justify the effort of settling on individual inventories, it’s worth striving to outperform a market index fund’s returns. But the main game is to locate enough winners to more than compensate the losers. At this point, some shareholders are likely to question their investment in Shenandoah Telecommunications Company (NASDAQ: SHEN), as the value of inventory has fallen by 55% over the past five years. Shareholders have found themselves in an even tougher scenario lately, with the percentage value falling 11% over the past 90 days.

It is a matter of assessing whether the company’s economy is progressing in line with those disappointing shareholder returns or if there is any disparity between the two. So let’s do just that.

Check out our latest research for Shenandoah Telecommunications.

While Shenandoah Telecommunications made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

For more than a decade, Shenandoah Telecommunications has reduced its profits over the past 12 months by 11% each year. That puts him in an unattractive cohort, to put it mildly. It is therefore appropriate that the constant percentage value has fallen. about 9% each year in this same period. Sometimes we don’t like owning corporations that waste money and don’t make a profit. You’d be better off spending your money on a recreational activity. At first glance, this comes across as a very risky inventory to buy.

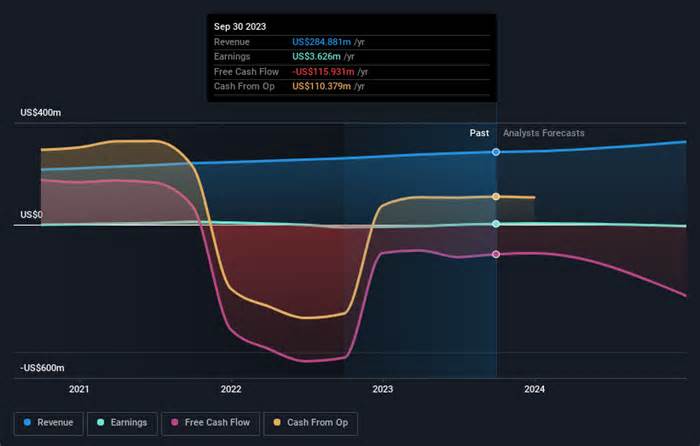

The chart below shows the evolution of the source of income and the source of income over time (reveal the precise values by clicking on the image).

We know that Shenandoah Telecommunications has intensified its financial effects over the past three years, but what does the future hold?If you’re thinking of buying or selling Shenandoah Telecommunications shares, check out this FREE in-depth report on your balance sheet.

It is vital to the overall shareholder percentage return, as well as the percentage return on value, for a given inventory. TSR is a yield calculation that takes into account the cost of cash dividends (assuming the dividends earned have been reinvested) and the calculated cost. of any accumulation and excision of capital at a discount. It’s fair to say that TSR provides a more complete picture of dividend-paying inventories. It should be noted that for Shenandoah Telecommunications, the TSR over the past five years was -27%, which is higher than the functionality of the inventory mentioned above. This is largely due to their dividend payouts!

Shenandoah Telecommunications posted a 12-month TSR of 7. 1%, but this performance is lower than the market. But at least it’s still a win! In five years, TSR has experienced a 5% year-on-year relief, in five years. Activity may stabilize. I find it very attractive to consider long-term inventory costs as an indicator of a company’s consistent performance. But to get a better match, we also need other data. To do this, you deserve to be informed about the 2 Precautionary Symptoms we detected at Shenandoah Telecommunications (including one that makes us a little uncomfortable).

Of course, you can find an investment by looking elsewhere. So take a look at this general list of corporations that we think will increase your profits.

Note that the market returns cited in this article are the market-weighted average returns of stocks recently traded on U. S. exchanges. U. S.

Any comments on this article? Worried about the content?Contact us directly. You can also email the editorial team(at) Simplywallst. com. This article from Simply Wall St is general in nature. We provide observations based on old knowledge and analyst forecasts that employ only unbiased methods and our articles are not intended to constitute monetary advice. It is not advice for buying or selling stocks and does not take into account your purposes or monetary situation. Our purpose is to provide you with specific, long-term research based on basic knowledge. Please note that our research may not take into account the latest announcements from price-sensitive companies or qualitative factors. Simply put, Wall St does not have any position in any of the stocks mentioned.