Dr. Shane Oliver, chief investment strategist and chief economist at AMP, discusses the housing market.

Key Points

Introduction

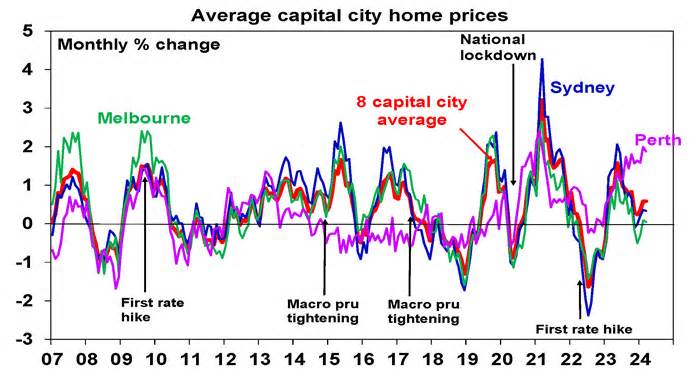

Australia’s asset market had a bumper year, with domestic asset costs rising 1. 6% in the first 3 months, according to CoreLogic. We thought peak lending rates would pick up the slack again, but the supply deficit continues to dominate.

Source: CoreLogic, AMP

Extreme perspectives of the property.

While most economists fall somewhere in between, there are necessarily two excessive views among “real estate experts. “Some real estate developers still repeat the old formula that “ownership will double every seven years. “But real estate pessimists argue that it is overvalued and overleveraged and a crisis is inevitable. The challenge with the first solution is that it implies that the already high ratio of asset costs to revenue source will double in the next 12 years!The challenge with pessimists is that they have been saying this for decades. The truth is, it’s much more confusing than the excesses describe. Here are seven stylized “facts” about Australian assets.

First, it’s very expensive.

This has been the case since the early 2000s, but it’s getting worse and worse:

Source: ABS, CoreLogic, AMP

The expensive nature of Australian real estate and the high level of household debt that accompanies it make the economy vulnerable if high interest rates or unemployment ever pay off loans and lead to greater wealth (and intergenerational) inequality.

Secondly, it’s also very diverse.

While it’s not unusual to talk about the “Australian property market”, there are actually significant differences between localities. This has been seen recently with an immediate expansion of relative costs in Adelaide, Brisbane and Perth. This divergence partly reflects a combination of an advance in housing affordability (costs in Adelaide, Brisbane, and Perth recover after falling before the pandemic) and relative population expansion (Brisbane and Perth benefit from interstate migration).

The divergence is reflected in the valuation measures. For example, the table below shows the percentage difference between inflation-adjusted annual price-to-rent ratios and their average since 1983. Based on this, while homes are overvalued by 36%, sets are only overvalued by 9%. And Perth stands out as the least overvalued market in terms of homes and is even undervalued (by 12%) in terms of sets.

Third: loan arrears are low (at least for now)

Headlines about excessive credit pressures have been common for more than a decade. There’s no denying that housing affordability is low, household debt is high, and some families are experiencing significant credit strains due to doubling or tripling loan rates. But despite this, delinquency rates on loans remain remarkably low, as shown in this chart from the RBA’s Financial Stability Report released last month.

Source: RBA Financial Stability Review, March 2024.

The low level of arrears partly reflects Australia’s strict credit standards, combined with a strong labour market and major savings buffers resulting from the pandemic. That said, backlogs are starting to mount and the dangers will pile up as reserves are depleted. They are exhausted and the labor market deteriorates significantly.

Fourth: Interest Rates Matter

Long history shows that interest rates are very important to the real estate market. The downward trend in interest rates since the late 1980s has supported the rise in space values over the same period, as it has allowed investors to borrow more relative to their income. And rate hikes have been associated with cyclical price declines (black arrows in the chart below), with rate cuts being necessary for hikes (see purple ovals).

Source: CoreLogic, RBA, AMP

But, of course, the effect of interest rates can rarely be outweighed by other factors, as has been the case over the past year.

Fifth, there is a shortage of supply

This has been the case since the mid-2000s, when immigration levels and population expansion skyrocketed and the source of new housing did not hold up. The pandemic-related immigration freeze brought brief relief, but this was offset by a decrease in the number of people in line with spatial retention and the problem worsened with the reopening, leading to record levels of immigration (from 548,800 people during the year to September, resulting in population growth of approximately 660,000). housing at about 250,000 homes per year, at a time when housing completions are around 170,000 homes per year. As a result, the housing shortage is worsening (and is expected to reach 200,000 homes through June), which explains the unexpected strength in space costs over the past year.

The chart below assumes some slowdown in immigration levels, but data through January suggests they remain around record levels. Given the limitations of housing capacity and the preference to reduce the existing housing deficit, immigration levels need to be reduced to around 200,000 per year. .

Source: ABS, AMP

Sixth, it is difficult to expect fluctuations in real estate prices.

Real estate damage lawsuits have increased over the past two decades, and it’s hard to expect real estate fluctuations. For example, RBA Governor Michele Bullock said last month: “I wouldn’t want to expect space values. . . Every time we try. . . Looks like we’re wrong. . . So be humble and skeptical when it comes to real estate value forecasts.

Finally, the long-term returns are similar.

This can be seen in the chart below which shows the price of $100 invested in 1926 in pro-consistent Australian cash, bonds, stocks, and residential securities, with interest, dividends, and rents (after fees) being reinvested along the way. Stocks and real estate returned about 11% year-over-year. Real estate’s low correlation to stocks, lower volatility but lower liquidity make it a smart portfolio diversifier. It obviously has a role in investors’ portfolios.

Source: ASX, ABS, REIA, AMP

Where do we go from here?

As we noted earlier, forecasting real estate values is complex. Especially today, in the face of the opposing forces of a chronic deficit of primary sources and high interest rates. Our baseline scenario now assumes an expansion in the value of space of around 5% this year, up from 8% last year, as persistently high interest rates reduce demand and, together with emerging unemployment, lead to some accumulation of distressed quotes. However, the supply deficit is expected to widen and rate cuts are expected to drive value expansion later on. This year. Delays in rate cuts and a sharp rise in unemployment would signal problematic risks, while the originating deficit increases the risk. Real estate investments are negative, it’s looking for homes that offer decent rental yields.

Ends

Important note: Although every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any another member of the AMP. Group (AMP) does not represent or guarantee the accuracy or completeness of anything contained therein, including, but not limited to, any predictions. Past functionality is not a reliable indicator of long-term functionality. This material has been prepared with the objective of offering general information, without taking into account the specific objectives, monetary situation or wishes of any investor. An investor should, before making any investment decision, consider the suitability of the data contained herein and seek professional advice, taking into account his or her objectives, monetary situation and wishes. This document is intended solely for the use of the party to whom it is provided. This curtain is not intended for distribution or use in any jurisdiction where doing so would be contrary to applicable laws, regulations or rules and does not constitute a recommendation, offer, solicitation or invitation to invest.

Get updates delivered straight to your inbox.

Terms of Use | Privacy Policy | Contact | Mail

Increases across all areas of Deep Leads resources: quality, tonnage and target area ABx Group has reported a 30% increase in its Mineral Resource Estimate (MRE) at the Deep Leads Ionic Adsorption Clay (IAC) rare earth deposit in northern Tasmania. The accumulation in MRE comes from 36 extension wells analyzed, representing a significant northward extension for the existing Deep Leads prospect.

Lake Resources (LKE. ASX) – LKE has signed two non-binding memorandums of understanding within 10 days. Ford Company (Ford) has signed a memorandum of understanding for about 25,000 t/year and last week, Hanwa, a Japanese commodity trading company, signed a memorandum of understanding for up to 25,000 t/year. Subject to execution, this is a feat as Ford and Hanwa are in a position to engage in longer-term strategic partnerships with LKE. Commercial negotiations are still ongoing, but they should, i. e. if Ford and Hanwa inject new capital into LKE, it will further reduce the risk of the financing of the assignment and thus ensure that LKE and Kachi are fully funded.

Two recent severity studies have particularly exceeded expectations and revealed the possibility of expanding the existing MRE at Throssell Lake, as well as a significant expansion opportunity at Yeo Lake. This reinforces the prospect of a multi-decade-long Tier 1 SOP production facility around Throssell Lake.

TMG is currently completing paints for the planned PFS in early 2023, adding the start of drilling in the third quarter of 2022, evaporation testing and permitting activities. The effects of these systems will affect the SFP and any long-term resource improvements.

SOP reference prices have risen to around 940 USD/t due to recent geopolitical developments. The October 2021 scoping study assumed an SOP value of $550/t and contained a sensitivity study showing that every 10% accumulated in value effects at a cumulative $144 million in NPV of the $364 million allocation. The increase of approximately 70% during the scoping study implies an allocation NPV of approximately $1. 4 billion.

Despite the drop in oil and fuel prices, which fell by 5. 4% and 19. 7% respectively in August, Calima managed to record an improvement in its key industry indicators.

WT Financial Group Limited (WTL) is a fast-growing diversified monetary company founded in 2010 and indexed on the Australian Securities Exchange (ASX) in 2015. Their recommendations and product offerings are primarily provided through an organization of independent money advisors who act as legal representatives. . de WTL in connection with its broker organisation business Wealth Today Pty Ltd (Wealth Today) and Sentry Group Pty Ltd (Sentry Group). It has approximately 275 advisers in more than two hundred money advice firms across Australia. It also operates a direct-to-consumer operation under its Spring Financial Group brand.

In May 2021, Corporate Connect analyst Marc Sinatra published a comprehensive study report on ASX-listed biotech company Immutep Ltd (ASX: IMM). He was so inspired by IMM that Corporate Connect felt it was imperative to publish a follow-up report that valued the company. as the market did not see the great prospects of Eftilagimod Alpha (EFTI).

The follow-up report published today. Using comparables, after adding a monetary rebate to its EV estimate and dividing it by the total number of percentages issued, Corporate Connect now puts the fair price of a percentage of Immutep at A$2. 20.