“O.itemList.length” “- this.config.text.ariaShown

“This.config.text.ariaFermé”

Frank Sands (Trades, Portfolio), of Sands Capital Management, manages a $41.32 billion equity portfolio of 77 shares at the end of the quarter. The Company sold shares of the following shares in the last quarter of 2020.

Warning! GuruFocus detected four symptoms of caution with BABA. Click here to exit.

30-year monetary knowledge for BABA

The intrinsic of BABA

Baba Peter Lynch painting

Alibaba

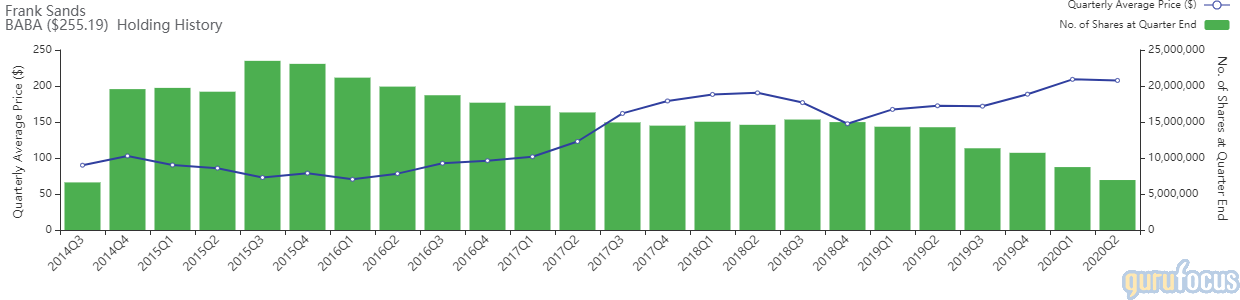

The fund reduced its position at Alibaba Group Holding Ltd. (BABA) by 20.58%. The industry had an effect of -1.17% on the portfolio.

The Chinese e-commerce and mobile company has a market capitalization of $690.20 billion and a $675.85 billion business.

GuruFocus provides the company with a profitability and expansion score of nine out of 10. The equity performance of 23.68% and the return on assets of 12.78% exceed nine1% of companies in the cyclical retail sector. Its monetary strength has a rating of 7 out of 10. The cash-debt ratio of 2.47 is higher than the industry median of 0.46.

The company’s gurú shareholder is PRIMECAP Management (Trades, Portfolio) with 0.51% of the shares outstanding, followed by Ken Fisher (Trades, Portfolio) with 0.50%.

Salesforce.com

The fund reduced its stake in Salesforce.com Inc. (CRM) by 93.4%. The portfolio had an impact of -1.15%.

The enterprise cloud computing response provider has a market capitalization of $173.55 billion and a $169.59 billion business.

GuruFocus provides the company with a profitability and expansion score of five out of 10. The return to equity of -0.62% and the return to assets of -0.37% are a return of less than five8% of companies in the software industry. Its monetary strength has a rating of 7 out of 10. The cash-debt ratio of 1.68 is higher than the industry median of 2.2.

The company’s largest shareholder is Fisher with 1.28% of the shares outstanding, followed by Spiros Segalas (Trades, Portfolio) Harbour Capital with 0.80% and Pioneer Investments (Trades, Portfolio) with 0.32%.

Activision

The fund reduced its position on Activision Blizzard Inc. (ATVI) by 96.96%. The portfolio had an impact of -0.94%.

The video game editor has a market capitalization of $63.07 billion and a $59.41 billion business.

GuruFocus provides the company with a profitability and expansion score of nine out of 10. The 14.23% equity return and 9.55% return on assets exceed 75% of companies in the interactive media sector. Its monetary strength has a rating of 7 out of 10. The debt ratio of 2.37 is lower than the industry median of 4.38.

The shareholder guru is PRIMECAP Management (Trades, Portfolio) with 0.95% of the shares outstanding, followed by Stanley Druckenmiller (Trades, Portfolio) with 0.20% and George Soros (Trades, Portfolio) with 0.14%.

Visa

The fund reduced its stake in Visa Inc. (V) by 6.3%, impacting the portfolio by -0.47%.

The payment processor has a market capitalization of $463.32 billion and a business of $445.86 billion.

GuruFocus provides the company with a profitability and expansion score of nine out of 10. The 33.57 per cent equity yield and the return on assets of 15.nine6% exceed nine6% of companies in the credit sector. Its monetary strength has a rating of 7 out of 10. The cash-debt ratio of 0.8 is higher than the industry median of 0.2 nine.

The company’s largest shareholder is Fisher with 0.99% of the shares outstanding, followed by Warren Buffett’s Berkshire Hathaway (Trades, Portfolio) with 0.50% and Chuck Akre (Trades, Portfolio) with 0.25%.

Shopify

The investment fund reduced its stake in Shopify Inc. (SHOP) by 25.03%. impacting the portfolio by -0.44%.

The company has a market capitalization of $118.42 billion and a business of $114.48 billion.

GuruFocus provides the company with a profitability and expansion score of 3 out of 10. The return to equity of -2.14% and the return to assets of -1.9% perform below 63% of companies in the software industry. Its monetary strength has a rating of 8 out of 10. The cash-debt ratio of 26.13 is well above the industry median of 2.2.

The shareholder is Lone Pine Capital (Trades, Portfolio) of Steve Mandel with 1.40% of the shares outstanding, followed by Segalas with 0.67% and Renaissance Technologies (Trades, Portfolio) by Jim Simons with 0.06%.

Adobe

The investment fund reduced its position in Adobe Inc. (ADBE) by 25.03%. The portfolio had an impact of -0.41%.

The company has a market capitalization of $213.62 billion and a $213.97 billion business.

GuruFocus provides the company with a profitability and expansion score of nine out of 10. The 35.54% return on equity and the return to assets of 17.91% exceed 9% of companies in the software industry. Its monetary strength has a rating of 7 out of 10. The debt ratio of 0.93 is lower than the industry median of 2.2.

The company’s gurú shareholder is PRIMECAP Management (Trades, Portfolio) with 2.59% of the shares outstanding, followed by Fisher with 1.11%.

Alphabet

The investment fund reduced its stake in Alphabet Inc. (GOOGL) by 10.53%. The portfolio had an impact of -0.38%.

The company has a market capitalization of $1 trillion and a business of $920 billion.

GuruFocus provides the company with a profitability and expansion score of nine out of 10. The 15.77 per cent equity return and 11.7 per cent return on assets outweigh 77 per cent of companies in the interactive media sector. Its monetary strength has a rating of nine out of 10. The cash-debt ratio of 7.5 is higher than the industry median of 4.37.

The company’s gurú shareholder is PRIMECAP Management (Trades, Portfolio) with 0.25% of the shares outstanding, followed by Fisher with 0.23% and Frank Sands (Trades, Portfolio) with 0.14%.

The investment fund reduced its stake in Facebook Inc. (FB) by 12.91%. Trading had an effect of -0.38% on the portfolio.

The social media company has a market capitalization of $744 billion and a $696 billion business.

GuruFocus provides the company with a profitability and expansion score of nine out of 10. The equity performance of 23.54% and the return on assets of 18.01% exceed 88% of companies in the interactive media sector. Its monetary strength has a rating of 8 out of 10 with a cash-debt ratio of 5.53.

The company’s main shareholder is Chase Coleman’s Tiger Global Management (Trades, Portfolio) with 0.31% of the shares outstanding, followed by Pioneer Investments (Trades, Portfolio) with 0.21% and Segalas with 0.17%.

Disclosure: I own any of the above actions.

Read here:

Akre Capital Management Markel and Primo Water

First Eagle Investment leaves JD.com and cuts Broadcom

Diamond Hill Capital leaves Raytheon and Microsoft

Not a GuruFocus Premium member? Sign up for a 7-day drop-off trial.

This article was first published on GuruFocus.

Warning! GuruFocus detected four symptoms of caution with BABA. Click here to exit.

30-year monetary knowledge for BABA

The intrinsic of BABA

Baba Peter Lynch painting