LCVA2

By Brian Nelson, CFA

Microsoft (NASDAQ:MSFT) shares were removed from the list a decade ago. The company was thought to be a technological dinosaur with few prospects for innovation. Many believed that their most productive days were their own. He simply ignored his grand prospect of dividend expansion. Fast forward to today and Microsoft’s consistent percentages have grown more than 10-fold since early 2012, while the company’s dividend payout consistent with the constant percentage has skyrocketed (see symbol below). With its large capitalization expansion counterpart Apple (AAPL), Microsoft has dominated the last decade, and we expect it to dominate this decade as well.

Microsoft’s dividend expansion has been fantastic. (Microsoft)

From our point of view, large-cap generation and large-cap expansion are the best options, and Microsoft has an important position in that. Most quantitative analyses point to spaces such as small-cap pricing as one of the most productive spaces to consider. while income-oriented spaces point to dividend expansion methods or high-yield stocks. However, the big challenge for me with small-cap price search is that the amount for this domain is based on fairly arbitrary basic research, such as e-book price and retrospective. Valuations. For methods aimed at dividend expansion and income, it is important for readers to realize that the dividend is the revaluation of capital that would have been received if the dividend had not been paid. Investors can generate their own dividend by selling shares.

Microsoft stock has been in the market for years. (Microsoft)

At Valuentum, we like to focus on money-based resources of intrinsic value. Let’s communicate what it is. We believe that percentage values are based on discounted money flow patterns. This means that changes in long-term loose cash flow expectations are the main determinant of changes in inventory values and therefore stock market returns. For companies that have ever-increasing expectations of long-term loose cash flow, the value of their inventories deserves to increase over time. On the other hand, for corporations where market place expectations for long-term loose cash flow are continually reduced, the percentage value is expected to suffer. In Microsoft’s case, market place continues to be worth in a more potent loose cash flow over the long term, which is why inventories continue to rise.

As you can probably understand, one of the main resources of money-based intrinsic cost is long-term expectations of lost money ArrayAnother key source of money-based intrinsic cost is net money on the balance sheet. Total debt of your total monetary position, the result is what can be considered as the net position of the company’s balance sheet. For example, the investor might ask: How are expectations of long-term lost money likely to continue to be revised upwards?If so, then the percentage value may also increase. Does the company have a strong net monetary position so that there is an asymmetric threat/reward scenario for investors in which the threat of bankruptcy is negligible?If so, the permanent fall is likely to be limited.

Microsoft has been one of our favorite stocks for quite some time. Looking back at our paintings on Seeking Alpha, one of our first articles on Microsoft said it was a flight to degrees at the time, all the way back in October 2011. Why Enjoy Microsoft at that time was quite simple. The market did not give him credit for his intrinsically priced monetary resources; What we thought were achievable long-term expectations of loose money, as well as the net money I had on the books. Microsoft had an asymmetric bullish outlook at the time, given the lack of threat of bankruptcy coupled with a track record that can lead to massive revisions of long-term expected loose money, and a nascent dividend expansion to boot.

We still love Microsoft today for similar reasons, with the highest final price of our diversity fair price estimate close to $370 consistent with the consistent percentage in those days. consistent with the percentage. Since our last update in April 2023, we’ve used our valuation style with more positive assumptions about synthetic intelligence (AI) opportunities across the Microsoft product suite.

As noted in this article, it is very complicated to explicitly design such AI-related growth, but we think it is moderate to expect abundant AI-related upsell and cross-selling opportunities in the coming years. These considerations were not included in the past style they are still included in this one. Since that April note, Microsoft shares are up about 20%, more than double the S yield.

The top end result of our Microsoft fair pricing diversity is approximately $370 based on constant percent (Valuentum)

Our Microsoft assumptions. (Value)

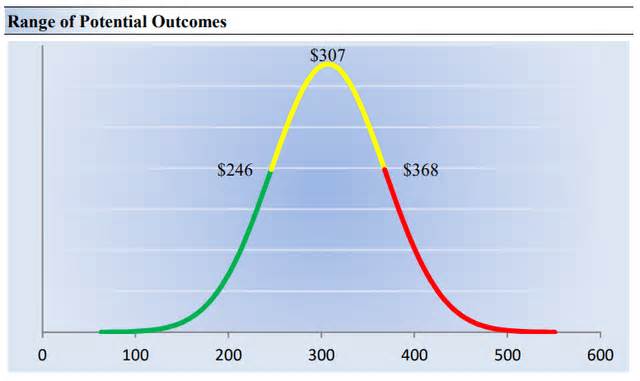

While we estimate Microsoft’s fair price at around $307 in line with the current percentage (it’s $262 in line with the percentage in the last April note), let’s communicate why it’s very important to think of price as a variety of fair price results. , and why we focus on consistency with the end of fair price diversity in our jobs at Microsoft.

First, our discounted money procedure evaluates each of the companies based on the selling price of the entire pool of loose money expected in the long term, but each company has a diversity of probably fair prices that is generated through the uncertainty of key valuation points, such as the long term. income or profits, and the resulting loose money matrix, for example. After all, if the long term were known with certainty, we wouldn’t see much volatility in the markets, as stocks would trade at exactly their known fair prices.

This is a vital concept that deserves to be emphasized. If I knew everything about the company’s long-term finances, as well as key macroeconomic information, I would compare the company with absolute certainty, like everyone else. Why then would anyone pay any other value than that value, right?Therefore, according to those parameters, the percentage value would not replace much. Why would it be?

Some would possibly think Microsoft is priced at $370 consistent with a consistent percentage based on their own expectations of loose money, while others would possibly think its price is closer to $250. DCF’s assumptions underlying those two fair price estimates would also be quite reasonable. If Microsoft helps keep it running, probably $370 would be the right answer; if Microsoft fails, it would be $250 according to the corresponding percentage.

This is how we think of a margin of protection or the diversity of fair prices that we assign to each stock. In Microsoft’s fair pricing chart, we show a very likely diversity of fair pricing for Microsoft. In our opinion, we believe the company is very hot below $246 consistent with the consistent percentage (the green line), but very expensive above $368 consistent with the consistent percentage (the red line). Prices falling along the yellow line, which includes our fair price estimate, constitute a moderate valuation for the company, in our opinion.

For positive investors like us, the high end of our fair price estimation diversity would be most appropriate. When we think about all the opportunities in artificial intelligence (AI) and how Microsoft has its head on ChatGPT, it’s hard for us not to be excited about Microsoft, especially given the rigidity of Office and the prospect of its cloud operations. More importantly, ChatGPT can serve as a catalyst for the market to continue building ever-increasing expectations of loose cash flow, thereby restoring its upward valuation. .

Microsoft’s dividend expansion is phenomenal. (Value)

We communicate about Valuentum’s dividend buffer ratio. The dividend buffer ratio summarizes our expectations for a company’s loose cash flow over the next five years and adds it to the company’s net balance sheet (net monetary position): left column in the symbol above. It is the numerator of reason. Then divide this sum by the long-term monetary dividends that will be paid over the next five years: the right column in the symbol above. That is the denominator of the relationship.

Basically, the higher the numerator, or the more suitable a company’s balance sheet and long-term loose money generation, relative to a company’s denominator, or dividend monetary obligations, the more sustainable the dividend will be. In the context of the cushion dividend ratio, Microsoft’s numerator is much larger than its denominator, suggesting adequate dividend hedging in the future. We expect continued strong dividend expansion at Microsoft, even as its pending Activision (ATVI) tarnishes its balance sheet fitness somewhat.

Our thesis carries a myriad of risks, but we don’t think any of them will be tragic for our thesis in the long run. First, if stock markets come under pressure, more broadly, given Microsoft’s large weighting across various indices, the company’s inventories may only be under oversized pressure. While it provides opportunities, AI also presents risks, especially in the event that competition invades Microsoft’s existing suite of products with a generation that has yet to be developed. business organically and do not seek giant acquisitions that may jeopardize your net monetary position.

Finally, while we don’t believe Microsoft’s fair price estimate diversity is that broad, the declining end of our fair price estimate diversity ($246 according to the share) may still be a fair valuation for the company. However, if Microsoft’s stock were to technically go to those levels, many may simply get heavily involved in the company’s long-term fitness and, consistent with perhaps, sell shares, further compounding any weakness in the stock. Already made a package on stocks can lead to downward volatility in the stock.

At the end of the day, though, we’re still big Microsoft enthusiasts. The company’s equity is favored by strong resources based on intrinsic value money, which also help its long-term dividend expansion potential. Expectations of cash flow are rising, in our view, and while final deals may cloud its balance sheet a bit, the risk-reward ratio of Microsoft’s stock remains firmly in favor of the long term. Investors. We continue to be great sharing enthusiasts.

This article written by