MagioreStock/iStock Editorial Getty Images

Anyone who follows the stock market knows that, since inflation rose six months ago, the generation has been cracking. For the past decade, FAANG’s glamorous inventories have been the rock stars of the stock market, to blame for much of S’s impressive earnings.

Understanding how they might behave in the long run is not only for those who invest directly in those companies, but also for the many investors in QQQs and derivative indices where FAANGs, even after their recent fall in value, account for 40. 78% of the total. value. ETF.

Jim Cramer coined the acronym FAANG in 2013 to refer to the tech stocks of the day. The term is just a catchy reshuffle of the first initial Facebook (FB), which was renamed Meta Platforms, Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Google (GOOGL) (GOOG), renamed Alphabet.

But oh, how hard it fell! Alphabet’s value is completely in correction territory, with a drop of more than 21% over the past six months. Amazon has lost about 36% of its value since November. Metaplatforms fell 42% over the same period. It has fallen more than 72% in the last six months.

Six months of dramatic losses for FAANG shares

In search of alpha

At first glance, it might seem that Apple escaped the contagion. Until it found out, it fell 19. 72% on May 12, narrowly escaping the fall into correction territory.

Do those sharp declines make a wonderful buying opportunity for investors who lost the ability to bring in those stocks years ago?Or are we faced with an encouraging story of dynamic investments hitting a brick wall, ridiculous average valuations, and fickle investors leaving yesterday’s darlings as they go?in the next big thing?

By the time Cramer gave those stocks their catchy name, they were increasing profits at rates few stocks would reach.

By 2012, Facebook had higher profits by 66%. The following year, they increased by 101%. Although Facebook’s P/E hovered around 60 for the next six years, investors’ hopes were justified. Over the next five years, Facebook’s annual earnings expansion fluctuated from an impressive 86% to a low of 23%. *

In one year, in 2013, Amazon increased its profits by 756%, but to put it in context, those gains were only $0. 59 consistent with the consistent percentage of an inventory that ended the year worth $396. Investors who bought Amazon in 2013 ended up with a Ten Bagger, as their profit rose 10. 985%, from $0. 59 to $64. 81.

Since 2013, Netflix’s earnings consistent with the constant percentage have risen to 4323%, from $0. 26 in 2013 to a high of $11. 24 in 2021.

Facebook’s profits have grown 778% since 2014, from $1. 77 to a high of $13. 77 in 2021.

Since 2013, Google’s profits have grown 505%, from $22. 22 to a high of $112. 20 in 2021.

Apple, which until a few weeks ago was the inventory with the world’s largest market cap, increased its profits more slowly from the five FAANGs, but still quadrupled profits since 2013, expanding them by 395% from $1. 42 to $5. 61. Investors who bought one of those inventories a decade ago, when Maximum gave the impression of using highly inflated multiples, have done incredibly well.

This has led many experts to proclaim that they are now formidable values. Apple’s P/E ratio of 26. 40 is noted to be lower than that of the reliable, slow-growing aristocrat Procter.

Comparison with Procter

Procter Price, Profit and Dividend History

Fastgraphs. com

Looking at their valuations through the prism of FastGraphs’ forecast calculator, the two FAANG stocks that have experienced the worst deterioration in their value in the past three months appear to be well valued now. These are metaplatforms and Netflix.

We will examine them, along with the rest of the FAANGs, through the prism of the FastGraphs calculator that estimates a fair price diversity for an inventory by applying Graham Dodd’s formula to analysts’ consensus forecasts on long-term earnings. (In those charts, the thick diversity line represents the fair price calculated for long-term inventory with a diversity more or less represented through the clearer odiversity line. )

Metaplatforms (Facebook) at fair value

Quick charts

So, yes, Meta Platforms turns out to be in the right price range. But that said, you can see that profits are expected to fall next year, slowly recover in 2023, and only grow at a much faster rate in 2024. But first I conclude that Meta is a wonderful purchase at its current price, it deserves to keep in mind that the numbers for 2023 and 2024 are just forecasts. A long familiarity with analyst consensus forecasts has taught me that those forecasts tend to grow much larger. the more time. It’s only as a report on effects approaches that analysts revise them downward. This makes analysts look good, but it actually hurts investors who rely on forecasts that are more remote than a few months.

To emphasize this point, the back row of information on the FastGraphs Forecast Calculator chart shows how analyst estimates have been replaced over the past six months. This shows that analysts have revised down their Meta Platform earnings estimates every three months. There is no explanation as to why this trend will not continue.

Netflix is close to value

Netflix Fair Value (Fastgraphs. com)

Netflix also happens to be very close to the price right now. Like Meta Platforms, profits are expected to decline this year and then in 2023 and 2024. But again, you need to take those forecasts with caution.

The back row of the chart showing how analysts’ forecasts have been replaced over the past six months shows that those forecasts have fallen by about 30% over the past six months, falling every three months. We can be sure that Netflix’s profits will recover in this short period of time.

Amazon’s valuation is, as always, a ruin

Fastgraphs. com

Any investor who made the decision not to buy Amazon until it seemed well valued has never owned Amazon. They also missed out on the obscene capital gains they could have made if they had bought it at any time before 2018. sales have piled up over the past 20 years, very few of which have turned into reported profits, as Amazon has used most of its profits to fund its expansion as it has grown from an online bookstore to a publisher, a grocery company. , package delivery company, streaming service, cloud service, social media platform and advertising center.

But today’s Amazon may not be the same company that became the tenth bagger. Last year saw a shift of force from founder Jeff Bezos to Andy Jassy, leaving open the question of what Amazon’s long term will look like. Yes, Amazon saw a massive buildup in its covid-19 business closures when consumers could only shop online, however, lately analysts expect earnings to take a few years to adapt to what they were in 2021. Again, we see that over the past six months, analysts’ forecasts for 2023 and 2024 have also declined.

Google (Alphabet) Still Highly Sought After for Expected Earnings Growth

Fastgraphs. com

Alphabet increased its earnings a lot in the years between its IPO and 2019. Like other FAANG stocks, it has noticed a massive increase in sales due to increased online activity due to blockages. But those glory days are over now that most people have returned to their normal lifestyle. This has led Alphabet to now be on track to report profits in December 2022 that will constitute the first decline in earnings consistent with the percentage recorded.

Unlike the other stocks we just saw, analysts have cautiously increased their estimates of Alphabet’s long-term earnings for 2022, 2023 and 2024 over the past 3 months. But even so, they only estimate that Alphabet will grow at a quiet rate of 11. 29%. during this 3-year period.

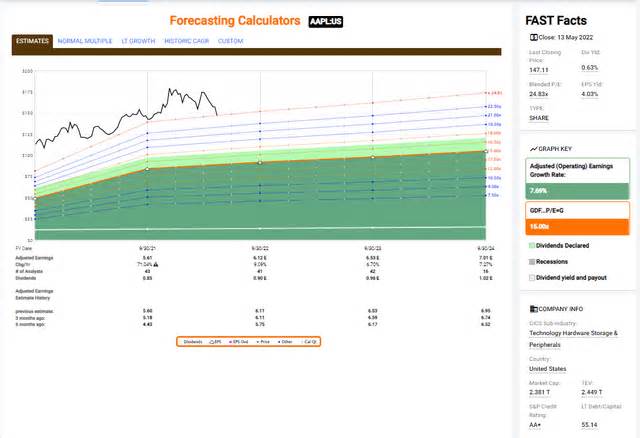

Apple is heavily overvalued by very modest long-term earnings growth

Fastgraphs. com

Apple is another stock that all investors wish they had bought years ago. And she, too, has benefited powerfully from COVID-19 lockdowns. But now it faces the fate of each and every one of the companies that have the largest in the world. When you have a market capitalization of $2. 38 trillion, double-digit expansion is becoming increasingly difficult. Companies are maturing and almost every No. 1 stock in fashion 30 or 40 years ago has now entered the ranks of heavy but reliable companies. dividend payers, appreciated through retirees. A generation ago, investors invested in Exxon Mobil (XOM), IBM (IBM) and GE as expansion stocks, just as investors are investing lately in Apple.

And this is where overvaluation becomes a problem. Apple is only expected to increase its profits over the next 3 years at a single-digit rate of 7. 69%, but its value remains that of an expansion stock, with a P/E ratio. Analysts have raised their earnings estimates for Apple over the past six months, but their higher optimism still only forecasts a 3-year growth rate well below 10%.

Apple’s expected profit expansion rate of 7. 69% indicates that the cloud is soaring over faanGs. It will take a resurgence of excessive expansion to justify the valuations at which Apple, Amazon and Alphabet are trading lately. This makes your movements have disappointing effects.

The brutal fixes That Meta Platforms and Netflix experienced last year show you how temporarily those fixes can occur.

Disappointing Benefits and Low Prospective Targeting Crash Platforms

In search of alpha

Meta’s price jumped from $323 per share to $277 in a single day, when the company announced fourth-quarter effects that missed consensus forecasts and posted disappointing forecasts.

Netflix’s value falls after being worried in the first quarter

In search of alpha

Netflix went from $348 per share to $226 in a single day after reporting a drop in subscriber numbers and the likelihood that they will decline further.

This kind of excessive collapse occurs when investors realize that no matter how successful their company is, their profits are not going to grow at a rate that justifies the maximum valuation they have assigned to it. It is quite imaginable that Apple, Alphabet and Amazon will revel in similar value collapses even when they report earnings that are not that far from analysts’ projections, if their forecasts recommend that they will actually increase their profits on average, a rate of 10% or less.

One can argue that Netflix has never belonged to the same discussion as the other FAANGs, as it is practically a one-shift pony, and its streaming and media production business has no gap. They compete for subscribers with the deep wallet of Amazon, Apple, Warner Bros. Discovery (WBD), Comcast (CMCSA) most of which have greater resources and run much more varied businesses.

Even when Netflix was at its peak when I wrote about QQQ on September 14, 2021, Netflix’s market cap of just $265 billion. This eclipsed Amazon’s market cap of $1. 757 trillion at the time. transmission business. In fact, in the fall of 2021, Apple, Alphabet, Amazon, and Facebook had market place capitalizations in excess of $1 trillion, Apple, Alphabet, and Amazon still have them.

Therefore, it can be argued that those 3 actions have much more in common with each other than with any other, regardless of what catchy acronym their first initials may make. Meta Platforms has struggled to diversify like the other more established FAANGs, it has not yet been successful yet.

This raises the issue of diversification of activities within the global business that took a position within FAANG minus Netflix. This internal diversification is essential to perceive its long-term performance.

Once upon a time, Google sold advertising, Amazon sold books and durable goods, Facebook provided sites where other people could simply brag to friends and family, while Apple sold computers, software, and smart devices to bring their favorite songs.

But as those corporations grew to dominate markets in the years after the currency crisis, they had to find a way to diversify their businesses, their profits to buy back or start entirely new profit streams.

As a result, Alphabet still sells advertising, but also sells hardware (Pixel phones, Nest, etc. ), books and media, a paid service (Google Pay), and cloud services.

Amazon still sells books and durable goods, but it also sells hardware: Alexa tablets and devices, its Prime streaming service, social media (Twitch), groceries, pharmaceuticals, and increasingly gains by promoting advertising to its merchants than by offering a marketplace. where they can sell. It is a pioneer in a payment formula to be used outside of Amazon.

Apple still mainly sells hardware and songs, but it’s also expanding its streaming, wearables, cloud (iCloud) and payment processing (Apple Pay) business.

Facebook has tried to diversify into other businesses besides its social networking sites. He has one foot in the virtual truth market with Oculus. But his control knows that to return to the billion-dollar club, Meta Platforms wants to diversify. of their questionable social networking sites. The existing drop in costs is largely due to Apple’s new operating formula that blocks trackers from its advertising business, hence the recent call change.

Meta Platforms social networking sites are still their core business. It has experimented with incentivizing users to use its social media sites as marketplaces, payment systems, and streaming platforms. It has also tried to market a hardware “portal” aimed at older consumers, none of those attempts have contributed much to its revenue.

But you see a style here. All those mega capitalizations compete for the most successful activities: advertising, markets, computer hardware, transmission, and payment systems.

There is a limit to the duration of those highly successful technology-related corporations. Since trillionaires compete with each other in those same niches, if they need to continue to increase their revenues, they will eventually have to expand into other successful corporations where the big players are still owned by smaller corporations. Amazon’s expansion into prescription drugs and grocery delivery is a good example. We could end up seeing iFunerals, Prime orthodontia, and Google Homes if all those super-rich, super-hard corporations continue to grow this path.

The history of the market teaches us the dangers that lurk in corporations that embrace diversification as a path to continued growth of competitive profits.

Microsoft (MSFT) stands out among all the mega-caps in its ability to reinvent itself decade after decade and remain at the top of the S&P 500 (SPY) and QQQ for more than 20 years. It has had its ups and downs, but although it failed to break into the mobile industry, it managed to go from selling hardware and software to becoming a major gaming and cloud player. But it’s important to note that, over time, he didn’t try to run many other types of businesses at once.

Microsoft has controlled to remain at the top for decades

In search of alpha

Microsoft’s long-term investors who held it during the value slump after the Dot. com boom were magnificently rewarded. It’s conceivable that FAANG minus Netflix can follow in their footsteps, especially Apple, which, like Microsoft, has a long history of profitability. even when it is not appreciated through investors.

General Electric (GE), meanwhile, lost its position in one of the S’s major stocks.

GE’s decline the wonderful bull market

In search of alpha

Market leaders from beyond whose corporations have reached the limits of imaginable expansion, such as IBM (IBM), Walmart (WMT) and McDonald’s (MCD), who have not figured out a way to diversify into other corporations that give them new prospects for expansion, have become the dividend payers in which retirees invest. This is the fate of many mature corporations. They are very profitable, very reliable, but they cannot accumulate their profits every year at a rate of 30% or more that would make them superstars of expansion stocks.

It’s quite conceivable that the FAANG minus Netflix is going in that direction. The other option may also be for those corporations to be able to manage increasingly diversified operations that expand all the remaining successful business niches and that have not yet been fully exploited through global operations. mega-caps. If they do, they could possibly continue to increase their revenue at competitive expansion rates, after a few years of consolidation following excess revenue due to blockages.

If you think those stocks can continue to diversify effectively and new lines of business that generate profits in particular, it makes sense to buy them after this recent pullback.

But if you think they’re more likely to stick to the same old trajectory of successful expansion corporations and end up squeezing stable dividend-paying stocks whose corporations make massive profits that only accumulate profits modestly year after year, it makes more sense to expect their costs to fall to a point that matches their very modest annual profit expansion rates lately. similar to dividefinish actions.

Apple is the maximum probably to fall into this category. Unlike other FAANGs, Apple is lately paying a small dividend: 0. 63% to be exact, although its yield has been much higher over the past five years. The only high-quality dividend stocks that lately boast of having a P/E ratio as high as Apple’s and are the ones that price-high investors are too expensive for their earning capacity.

Dividend aristocrats as a whole, represented through ProShares S

None of the other FAANGs pay dividends. Amazon is highly unlikely to follow this path given its track record of competitive expansion and its “conscious” attitude toward earnings growth. The Alphabet and Meta platforms actually have the profit to pay smart dividends, however, it is speculating on costs because they have passt never showed any inclination to do so.

Using the profit estimates we saw in previous FastGraphs to make a first step. If those stocks are successful in the costs indexed below, it would be time to delve into your finances and the existing situations of your beneficial business sectors.

For Apple, at present, this valuation-based value appears to be around $100 per share or less, based on existing earnings forecasts. its dividends increase to compete with other high-quality dividend stocks.

For Alphabet, that value looks like $1,832 per share, based on existing earnings estimates.

For Amazon, this value looks like around $1,000 per share assuming earnings in 2023. But take this with tweezers.

As beloved as metaplatforms seem to be right now, they may have too many vulnerabilities to be in the same verbal exchange as the “Three A’s. “It seems that he is betting the farm on the metaverse, which is a catchy word still for now, it is not much more than a concept. His business style on social media has been too polarizing and its effect on society, especially on young people who are attracted to Instagram influencers, has been so damaging that he is very likely to encounter more obstacles in the direction of the privacy policy of Apple, some of the foreign governing bodies.

_____

* All knowledge of earnings and P/E ratio is reported through FastGraphs between May 11 and 13, 2022 when this article was written.

This article written by

Disclosure: I have/have a long advantageous position in QQQ, PG shares, whether through ownership of shares, features or other derivatives. I wrote this article myself and expresses my own opinions. I don’t get any refund for this (other than Seeking Alpha). I have nothing to do with a company whose shares are discussed in this article.

Additional Disclosure: I am not a registered investment advisor. I’m just a very interested investor who likes to look for stocks and share what I find with others. Don’t buy or sell any securities you’ve read here until you’ve done your own studies and thought about opposing points of view.