“O.itemList.length” “- this.config.text.ariaShown

“This.config.text.ariaFermé”

IBM introduced its new next-generation power processor chip on Monday and is expected to have 3 times the workload capacity of its predecessor.

Designed to provide a platform that meets the desires of enterprise hybrid cloud computing for knowledge centers, the IBM (IBM) Power10 chip will be deployed by 2021. Expected capacity enhancement is designed to enable IBM Power10—systems were built to support up to 3x more users, workloads, and OpenShift container density for hybrid cloud workloads on IBM Power9 systems.

The Power10 is IBM’s first commercially available procedure, which will be manufactured through Samsung Electronics Co’s 7 nanometer procedural technology.

“Enterprise-grade hybrid clouds require a physically powerful onsite and offsite architecture that includes co-optimized hardware and software,” said Stephen Leonard, Director of MANAGEMENT at IBM Cognitive Systems. “With IBM Power10, we designed the first processor for the enterprise hybrid cloud, providing the functionality and security consumers expect from IBM. With our stated purpose of making Red Hat OpenShift the default selection for hybrid cloud, IBM Power10 provides hardware capacity and advanced container security to the IT infrastructure.”

The IBM Power10 processor is designed for faster encryption functionality with 4x more Advanced Encryption Standard (AES) encryption engines consistent with the center of its predecessor to meet expected long-term cryptographic criteria such as quantum security cryptography and fully homomorphic encryption. It also promises to make additional innovations in container safety.

The new processor chip has the ability to organize or group physical memories into your systems. IBM said that for cloud users and vendors, reminiscences creation has the ability to generate load and power savings, as cloud providers can offer more features and fewer servers, while cloud users can hire fewer resources to meet their IT needs.

IBM’s announcement comes after Intel last week unveiled a new generation of transistor production that would increase the functionality of its next processor circular by 20%. The U.S. chipmaker was affected after the company announced on July 23 that its 7nm transistor would be delayed until 2022, which analysts say will give its competition the merit of gaining market share.

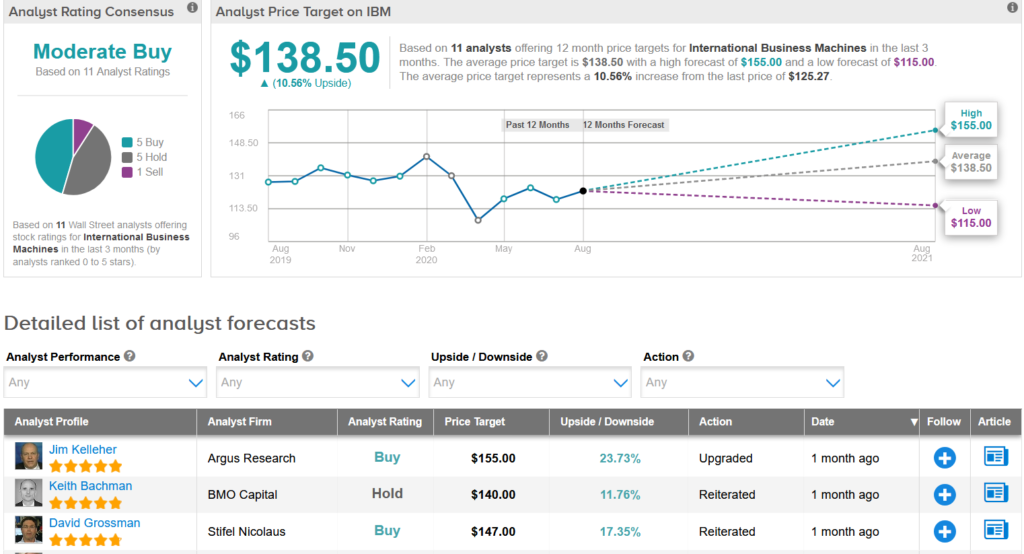

IBM shares, which recovered the top of this year’s losses, continue to fall 6.5% since the beginning of the year. Meanwhile, the average value target of $138.50 indicates 11% prospective accumulation for the next 12 months.

Late last month, Argus Research analyst Jim Kelleher upgraded IBM to Buy from Hold with a value target of $155 (potential 24% increase) because he believes the company has “crossed a line,” adding that some parts inherited from the company can remain. under pressure.

“The company’s hybrid cloud business is accelerating; the excess of low-yield service contracts has largely dissipated; and the deferred profit slowdown resulting from the red hat acquisition is declining,” Kelleher wrote in a note to investors. “Margins get advantages from software: a giant combination of activities, one step ahead through Red Hat. And the company’s demand for top consumers is resistant to the pandemic.”

The rest of the street has a cautiously positive outlook on inventory with a consensus of moderate purchasing analysts. (See IBM inventory market research in TipRanks).

Related news: Intel’s new generation of transistors to develop chip functionality across 20% of Facebook to Apple barks for refusing to give up 30% payment on China’s new Pinduoduo tool to sign up for Nasdaq-100, pushing NetApp

Sanofi to buy Principia Pharma for $3.68 billion

Microsoft seeks TikTok facilities in the UK: Report

Novavax launches Covid-19 vaccine efficacy trial in South Africa

Synopsys Results Summary: RBC Sees Quarter “Likely To Beat and Increase”