“O.itemList.length” “- this.config.text.ariaShown

“This.config.text.ariaFermé”

Coca-Cola European Partners (CCEP) has signed a multi-year hybrid cloud agreement with IBM Corp. to optimize your existing IT infrastructure, which aims to reduce operating prices and increase efficiency.

With the help of IBM (IBM), the world’s largest revenue-based bottler, Coca-Cola needs to drive its transition to an open hybrid cloud environment to create a platform for standardized business processes, knowledge, and technology. This resolution is designed to reduce operating expenses, increase IT resilience, and leverage analytics and synthetic intelligence (AI) in your day-to-day operations for business wisdom and the facilities of your millions of customers.

As a component of this agreement, IBM will assist CCEP (CCEP) in its virtual transformation by deploying the IBM public cloud and several significant workloads. IBM will also provide CCEP with a consolidated view and single checkpoint across its IT infrastructure.

“As companies turn to the cloud, we perceive that each and every industry and every single visitor has unique business desires in their cloud adoption adventure. IBM is very happy with CCEP in this upcoming bankruptcy of its cloud adventure by providing an industry-specific solution as they migrate their mission-critical workloads to the cloud,” said Howard Boville, senior vice president of IBM Cloud. “By deciding on IBM for its hybrid cloud environment, CCEP embarks on an adventure into an open and secure cloud architecture that promotes greater virtual advancement.

IBM will help CCEP modernize its Red Hat Enterprise Linux IT environment, which deserves to deliver an open and cost-effective popular platform. IBM’s multi-cloud control capability will be used to enable the integration and control of public and personal clouds from a single dashboard.

IBM shares, which have risen 6.6% over the following month, continue to fall by 5.2% since the beginning of the year. (See IBM inventory market research in TipRanks).

“The company’s hybrid cloud business is accelerating; the excess of low-yield service contracts has largely dissipated; and the deferred profit slowdown resulting from the red hat acquisition is declining,” Kelleher wrote in a note to investors. “Margins get advantages from software: a giant combination of activities, one step ahead through Red Hat. And the company’s call from top consumers is resistant to the pandemic.”

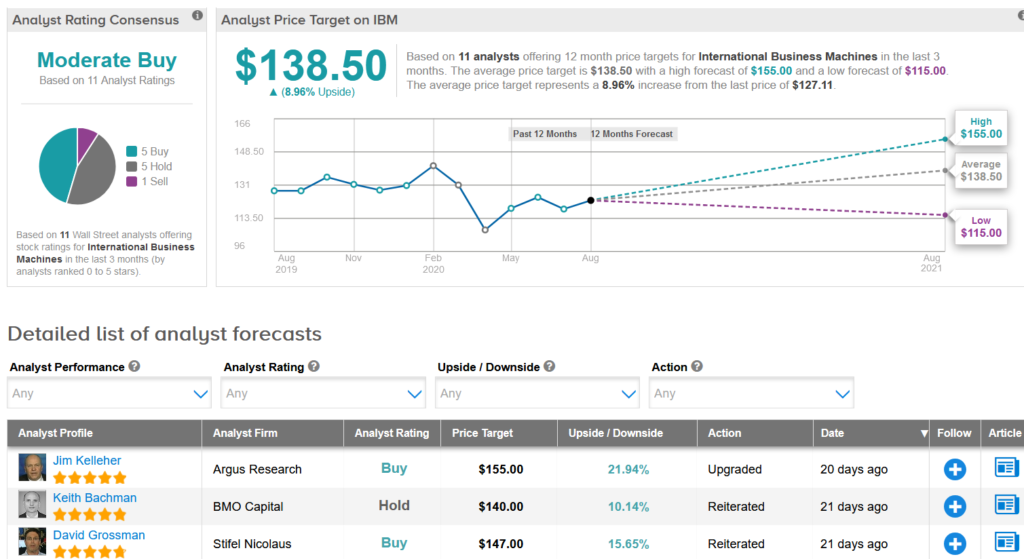

The rest of the street has a cautiously positive outlook on inventory with a consensus of moderate purchasing analysts. The average value target of $138.50 indicates a prospective accumulation of 9% for the next 12 months.

Related News: Qualcomm increases 12% after business hours in Huawei’s $1.8 billion license agreement increases annual earnings outlook while first quarter revenues increase by 75% IBM increases 5% in extended trading after quarterly earnings exceed expectations

Susquehanna raises PT in Dick’s game ahead of quarter results

Casper Sleep exceeds 2Q revenue; Shares fall more than 10%

Citigroup doubles Carvana PT in higher sales

Nio increases by 8% in record quarterly deliveries; But the cautious street