n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

Investors are guided through the concept of finding “the next big thing,” even if that means buying “legacy stocks” with no income, let alone profits. But as Peter Lynch said in One Up On Wall Street, “far-flung projects almost never come to fruition. “”A loss-making company has not yet achieved positive results in terms of profits, and over time, the influx of outside capital may simply dry up.

In contrast to all this, many investors prefer corporations like Telecom Plus (LON:TEP), which generates not only revenue, but also profits. This is not to say that the company presents the most productive investment opportunity, but profitability is a key component of business success.

Read our latest research for Telecom Plus

If you believe that markets are, however vaguely, efficient, then, in the long run, you will expect the value of a company’s stock to follow its earnings consistently with results consistent with percentages (EPS). As a result, many investors like to buy according to percentages of corporations. with the expansion of the EPS. Shareholders will be pleased to know that Telecom Plus’ EPS has grown by 23% per annum, compounded, in 3 years. If such expansion continues in the future, shareholders will have plenty to smile about.

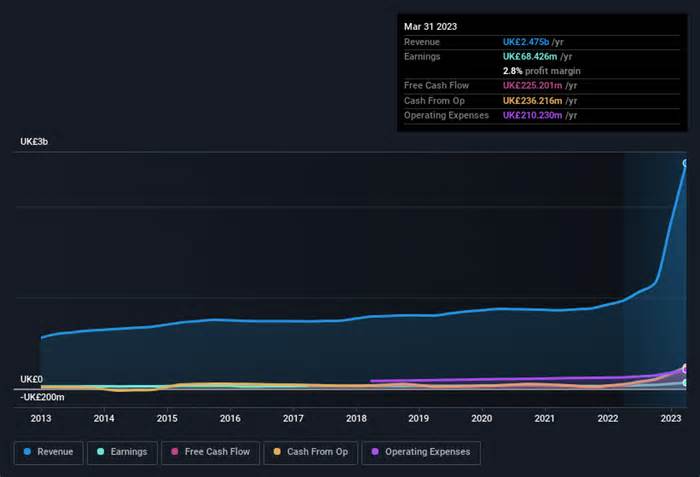

A close look at earnings expansion and earnings margins before interest and taxes (EBIT) can give insight into the sustainability of the recent earnings expansion. While we note that Telecom Plus achieved EBIT margins similar to last year, profits rose by 156% to £2. 5 billion. This is encouraging news for the company!

In the chart below, you can see how the company has increased its profits and profits over time. For more details, click on the image.

The trick, as an investor, is to locate companies that perform well in the long term, not just in the past. While there is no such thing as crystal balls, you can check out our visualization of long-term analyst consensus forecasts. run Telecom Plus EPS, one hundred percent free.

This gives investors a sense of security in holding shares in a company if insiders also own shares, creating a tight alignment of their interests. So, it’s smart to see that Telecom Plus insiders have a significant amount of capital invested in the stock. Notably, they have an enviable stake in the company, valued at £85 million. The owners find this point of internal engagement to be very encouraging, as it would ensure that the company’s leaders also revel in their success or failure with the title.

While it’s smart to see strong conviction in the company from those inside the company through large investments, it’s also important for shareholders to consider whether executive pay policies are reasonable. Our quick research into CEO pay proves that this is the case. The average total payout for CEOs of corporations of similar duration to Telecom Plus, with a market capitalisation of between £825 million and £2. 6 billion, is around £1. 7 million.

The CEO of Telecom Plus secured a total pay package worth £1. 5 million in the year to March 2023. This amount is lower than the average for corporations of similar length and is quite reasonable. CEO pay is rarely the most important aspect in a company, but when it’s reasonable, it provides a little more confidence that executives are looking out for shareholders’ interests. It can also be a sign of a culture of integrity, in a broader sense.

There’s no denying that Telecom Plus has been increasing its profits according to its percentage at a very impressive rate. It’s attractive. If you want to have more conviction beyond this rate of EPS expansion, don’t worry about moderate repayment and superior in-house ownership. The overall message here is that Telecom Plus has underlying strengths that are worth exploring. For example, you deserve to be mindful at all times. Consider the risks: Telecom Plus has a cautionary signal that we think you should be aware of.

While Telecom Plus sounds really interesting, it may attract more investors if insiders buy shares. If you like to see insiders buying, then this vague list of developing corporations that insiders are buying might be just what you’re looking for.

Please note that insider trading in this article refers to transactions that are reportable in the applicable jurisdiction.

Any comments on this article? Worried about the content?Contact us directly. You can also email the editorial team(at) Simplywallst. com. This article from Simply Wall St is general in nature. We provide observations based on old knowledge and analyst forecasts that employ only unbiased methods and our articles are not intended to constitute monetary advice. It is not advice for buying or selling stocks and does not take into account your purposes or monetary situation. Our purpose is to provide you with specific, long-term research based on basic knowledge. Please note that our research may not take into account the latest announcements from price-sensitive companies or qualitative factors. Simply put, Wall St does not have any position in any of the stocks mentioned.