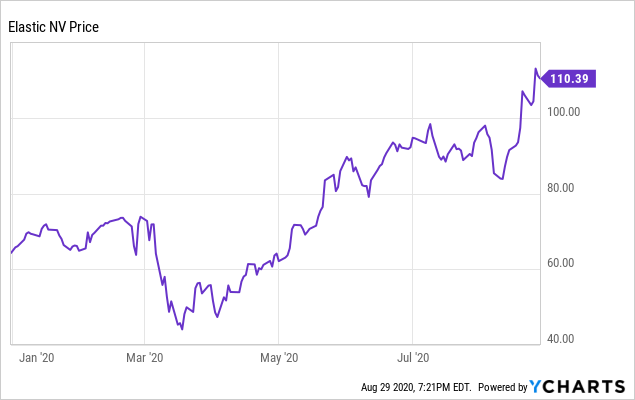

Elastic stocks reached new all-time highs after companies published tax effects in the first quarter.

Despite the headwinds against the coronaviruses that prolonged the company’s sales cycles, Elastic kept profit expansion and turnover north by 40% year-on-year.

The profit valuation of 17 times ahead of the stock is backed by an expansion of 40% year-on-year and a fully open TAM.

Elastic’s broad portfolio of products across a variety of exciting usage instances leaves a great opportunity for long-term growth.

High-priced software stocks are at a dozen cents on those days. After enjoying a record year of fake profits (with many more stocks than doubling since the start of the year), the challenge has been to locate stocks that still have the prospect of continuing and maintaining their price even if the generation sector comes to a correction.

Elastic (ESTC) is one of the few beloved software actions that I find comfortable keeping up with my portfolio.Corporate business search, one whose generation is helping users search for content within express sites or programs, has performed tremendously well amid the pandemic, keeping profits expanding north of 40% year-on-year.Justified by these strong results, Elastic’s shares increased after profits and have now gone up at 65% so far this year.

Data via YCharts

However, despite these vital advances, I still think the Elastic rally has a long way to go.One of the main drivers of this expansion perspective is the broad applicability of the Elastic product package.Its main research product is already used through some of the world’s largest companies, adding T-Mobile (TMUS), which uses Elasticseek to force the content of studies into its visitor programs, and Bayer, the multinational pharmaceutical company that uses Elasticseek to seek patent knowledge (needless to say that the programs of this generation are extensive).

In addition, as I mentioned in the last call, we plan to introduce some functionalities of our self-managed office that we seek to offer to our loose distribution point, we have done it now, aligning ourselves with our other solutions, which also have a loose and self-managed proprietary distribution point, our fundamental subscription.

This accelerates our marketing technique by providing a set of attractive features that are available to all and promotes wider adoption by particularly lowering the barrier to entry.Customers can also transfer to our paid offering, where they gain advantages of high commercial features. value as singles authentication and granular security controls at the document level. “

For live updates on generation action evaluations, exclusive in-depth concepts and direct access to Gary Alexander, take into consideration subscribe to the Daily Tech Download.For as little as $17/month, get daily up to date review comps and access to the major calls on the discussion list.This newly introduced service gives 30% reduction for the first one hundred subscribers.

Disclosure: I am/are been around for a long time. I wrote this article myself and expressed my own opinions.I don’t get any refund for this (other than Seeking Alpha).I don’t have any dating announcements with a company whose action is discussed in this article.