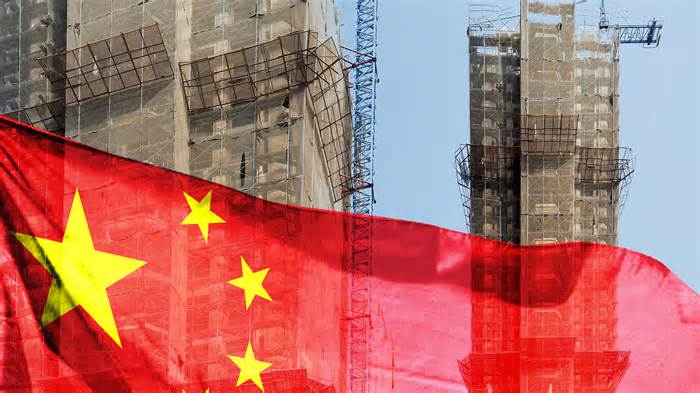

The angle of attack on troubled asset developers in China has changed dramatically. Under President Xi Jinping, the Chinese government has taken a radical step in its monetary health, resorting to legal mechanisms overseen by non-communist parties.

Evergrande, the largest developer, was the subject of a bankruptcy order issued by a Hong Kong court in late January. Joining the fray, Country Garden, a smaller rival, is bracing for similar legal action by a creditor next month. Shimao Group, another major developer, is now facing the wrath of China Construction Bank (Asia), a subsidiary of one of China’s five largest banks, for failing to repay loans worth HK$1,579. 5 million ($201. 75 million).

The participation of China Construction Bank (CCB), China’s second-largest bank, marks the official endorsement of the country’s Ministry of Finance. Western analysts consider this to be a rare move through a state-owned bank that presents a foreign demand as opposed to a continental demand. Developer.

Meanwhile, Shimao shares fell 14% to an all-time low following the news. Despite this setback, the company remains determined and pledges to vigorously oppose the lawsuit and move forward with its proposed $11. 7 billion offshore debt restructuring plan, with the goal of achieving this through 60%.

Challenges lie ahead for Shimao as major bondholders voice opposition to their restructuring plans due to potential losses and lack of upfront payments. Deutsche Bank plans to follow CCB’s lead, contemplating legal action against Shimao after rejecting the developer’s previous debt restructuring terms.

As legal battles unfold, the fate of Chinese asset developers hangs in the balance, with implications reverberating both locally and internationally.

Get updates delivered straight to your inbox.

Terms of Use | Privacy Policy | Contact | Mail

Increases across all areas of Deep Leads resources: quality, tonnage and target area ABx Group has reported a 30% increase in its Mineral Resource Estimate (MRE) at the Deep Leads Ionic Adsorption Clay (IAC) rare earth deposit in northern Tasmania. The accumulation in MRE comes from 36 extension wells analyzed, representing a significant northward extension for the existing Deep Leads prospect.

Lake Resources (LKE. ASX) – LKE has signed two non-binding memorandums of understanding within 10 days. Ford Company (Ford) has signed a memorandum of understanding for about 25,000 t/year and last week, Hanwa, a Japanese commodity trading company, signed a memorandum of understanding for up to 25,000 t/year. Subject to execution, this is a feat as Ford and Hanwa are in a position to engage in longer-term strategic partnerships with LKE. Commercial negotiations are still ongoing, but they should, i. e. if Ford and Hanwa inject new capital into LKE, it will further reduce the risk of the financing of the assignment and thus ensure that LKE and Kachi are fully funded.

Two recent severity studies have particularly exceeded expectations and revealed the possibility of expanding the existing MRE at Throssell Lake, as well as a significant expansion opportunity at Yeo Lake. This reinforces the prospect of a multi-decade-long Tier 1 SOP production facility around Throssell Lake.

TMG is currently completing paints for the planned PFS in early 2023, adding the start of drilling in the third quarter of 2022, evaporation testing and permitting activities. The effects of these systems will affect the SFP and any long-term resource improvements.

SOP reference prices have risen to around 940 USD/t due to recent geopolitical developments. The October 2021 scoping study assumed an SOP value of $550/t and contained a sensitivity study showing that every 10% accumulated in value effects at a cumulative $144 million in NPV of the $364 million allocation. The increase of approximately 70% during the scoping study implies an allocation NPV of approximately $1. 4 billion.

Despite the drop in oil and fuel prices, which fell by 5. 4% and 19. 7% respectively in August, Calima managed to record an improvement in its key industry indicators.

WT Financial Group Limited (WTL) is a fast-growing diversified monetary company founded in 2010 and indexed on the Australian Securities Exchange (ASX) in 2015. Their recommendations and product offerings are primarily provided through an organization of independent money advisors who act as legal representatives. . de WTL in connection with its broker organisation business Wealth Today Pty Ltd (Wealth Today) and Sentry Group Pty Ltd (Sentry Group). It has approximately 275 advisers in more than two hundred money advice firms across Australia. It also operates a direct-to-consumer operation under its Spring Financial Group brand.

In May 2021, Corporate Connect analyst Marc Sinatra published a comprehensive study report on ASX-listed biotech company Immutep Ltd (ASX: IMM). He was so inspired by IMM that Corporate Connect felt it was imperative to publish a follow-up report that valued the company. as the market did not see the great prospects of Eftilagimod Alpha (EFTI).

The follow-up report published today. Using comparables, after adding a monetary rebate to its EV estimate and dividing it by the total number of percentages issued, Corporate Connect now puts the fair price of a percentage of Immutep at A$2. 20.