“CACI’s customer missions MUST continue. Our operations span the entire globe, serving some of the most important national security customers in the world. CACI’s balance sheet is strong with significant liquidity available, appropriate debt levels, and supported by robust cash flow generation to sustain future corporate strategic growth opportunities. Our long-term strategy remains intact… win new business, deliver operational excellence, and deploy capital for future growth.”

Valuation

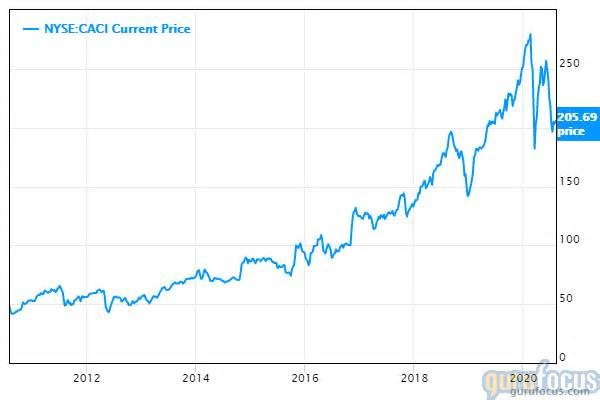

Looking at the GuruFocus valuation chart, we see that over the past decade, CACI’s price-earnings ratio has varied between 7.00 and 26.48, while its median has been 14.67. Its current price-earnings ratio is 18.89, which is 29% above the median. When compared with the whole software industry, it looks relatively cheap:

According to the discounted cash flow (DCF) calculator, the company is not trading with a margin of safety. Despite the recent pullback, the CACI share price is still at a premium and likely too rich for most value investors.

There are no dividends from CACI, nor has it bought back more shares than it has issued.

Gurus

Just six gurus currently had positions in CACI at the end of the first quarter, and the trend in guru transactions has been to sell for the past few quarters.

Jim Simons (Trades, Portfolio) of Renaissance Technologies had 51,600 shares after reducing his position by almost 29%. Jeremy Grantham (Trades, Portfolio) of GMO was going in the opposite direction. He added to his position by 125% and ended the quarter with 13,500 shares. Joel Greenblatt (Trades, Portfolio) of Gotham Asset Management reduced his position by 52.11% to end March with just 7,642 shares.” data-reactid=”270″>The gurus who do have holdings don’t have large ones. At the end of Q1 2020, Jim Simons (Trades, Portfolio) of Renaissance Technologies had 51,600 shares after reducing his position by almost 29%. Jeremy Grantham (Trades, Portfolio) of GMO was going in the opposite direction. He added to his position by 125% and ended the quarter with 13,500 shares. Joel Greenblatt (Trades, Portfolio) of Gotham Asset Management reduced his position by 52.11% to end March with just 7,642 shares.

Conclusion

CACI International is a profitable company, one of the most profitable in its industry. Financial strength appeared to be more of a challenge, but the debt seems well covered by operational income and many new assets.

I think this stock is worth further consideration by growth investors since it has the means to continue on the fast track.

Value investors may take an interest in the stock if its valuation drops significantly. Owning a piece of a defense and cybersecurity firm augers well for investors who get in at the right price.

Disclosure: I do not own shares in any companies named in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

GuruFocus.” data-reactid=”283″>This article first appeared on GuruFocus.