Did you know that Amazon has surpassed Google as the go-to search platform for shoppers looking for products?

This would possibly surprise many readers. (In fact, I’ve never heard of using “Amazon” as a verb). However, knowledge verifies it.

When consumers have an espresso product in mind, they’re looking for more on Amazon than google.

If you move your “best practices” by referring on-site product pages to Amazon product pages, you have difficulties. This article covers the main differences to help you thrive on any of the platforms.

Anyone who has been running in the search engine optimization box for some time will tell you that understanding the main purpose of a search engine is essential for a sustainable search engine optimization strategy.

Yes, the tactics of the moment can bring the ranking to life. But its use does not come at the expense of aligning your site with what search engines need to reward.

So what is the primary purpose, and the ideal user who delights, for Google and Amazon?

Comparatively speaking, Google’s task is more complex. Take outdoor grills as an example.

Google wants others to compare the use of charcoal and fuel barbecues, locate smart recipes for grilling, perceive other techniques (e.g., slow and low cooking versus cooking).

And you have to answer all those questions with limited knowledge: their visibility into the user’s delight decreases after leaving the SERP.

Consider the diversity of intent: buying grocery ads, local restaurants, fish frying techniques, and local retailers. Amazon’s rule set manages fewer users, those who intend to purchase a product online.

Amazon, on the other hand, is there to help buyers make a purchase decision. Every click or scroll is traceable in your ecosystem. Even after an acquisition, Amazon knows if it’s necessary to go back or what buyers think of the fun (via reviews).

Amazon’s rule set wants to solve a very limited diversity of user disruptions and wants to use a lot more knowledge to do so.

These basic differences stem from all tactical differences: those that require changes in titles or the way you advertise your e-commerce products on other sites.

Of course, everything wants to be reworked.

Yes, the search purposes of Google and Amazon are not the same. No, it’s no different:

So where do the two search engines diverge?

As long as the keyword is applicable to the product and appears in the list name, there is no need to saturate the description and tabs with the term.

On Amazon, top experts add the product, material, quantity, logo, and color to the title, which would be an overload in a Google search result.

(The maximum number of characters before a name is truncated is 129 characters on Amazon compared to about 60 on Google).

Consider All-Clad product pages and Amazon product lists:

It’s simple to see some of the keywords added to Amazon titles and how they can target user searches: “non-stick,” “dishwasher washable,” “hard anodized”.

This is why keyword search is paramount, not only for the apparent product call, but also for high-value descriptors. In fact, keyword search is indexed as one of the highest vital points for visibility into Amazon search.

Despite the availability of many teams to help distributors identify the most lucrative keywords, there is no easy way to do this. Yes, it starts with a tool to create the initial knowledge set for your search, but background paintings don’t stop it.

Entering the main description of your product into such a tool generates an impressive list of related keywords. But it’s an accurate science.

(Image source)

Each logo will have which keywords have this specific combination of relevance, top search volume and low festival, which have the possibility to generate sales only from biological studies.

Speaking of product descriptions: Amazon prefers bullets to text walls. For users, it is less difficult to scan a plug to see if a product has the features they want, especially on cellular devices.

And, for Amazon’s algorithm, bullets are a semi-structured way to imbibe information, which helps the search engine compare similar items (and rank them more effectively).

In the example above, separate the facets of the chip canopy, such as building materials, battery life, and microphone capabilities.

Remember the keywords? Once, Google allowed webmasters to empty a list of (alleged) words applicable in source code, hidden from users. As you expected, it wasn’t long before:

Amazon is still catching up, allowing distributors to come with “backend keywords,” such as similar terms, common spelling errors, and even foreign language versions.

These are freely visual in the source code if you are looking for your competitors:

The metawords for a manual drill.

This can also be an opportunity to return Amazon tutorials to your e-commerce site. If all top-ranked products represent a subset of backend keywords, they may also add value to your text.

Google has always pushed webmasters to optimize for the user—to match intent and solve user problems. The challenge, of course, is that “optimizing for the user” doesn’t always optimize for Google.

Recipes are an obvious example. Does anyone need this 1000-word non-public story on top of the ingredients and procedure list? No. Does it give search engines more context and a forward-looking explanation of why to rank it higher? Yes.

However, because Amazon has end-to-end analytics and is interested in sales, resellers can write that it persuades users to buy.

(Image source)

This justification also applies to facets of your Amazon product list:

Amazon can forget about surface metrics in a way that Google can’t, and resellers benefit.

Too often, the opposite happens at Google: we optimize the microconversion of a biological visit, even if it wins, sacrifices a component of the post-click experience, which has a negative effect on engagement and conversion.

With Amazon’s A10 update of your algorithm, from external sites it becomes more important.

This would possibly seem to overlap with Google’s affinity for backlinks, but there is a difference. Amazon focuses on referral traffic, comparing only links that generate page views.

This makes a lot of sense:

Calls to action on those external links are much more for Amazon than for Google.

An e-commerce site that tries to get its rating on Google benefits the most from links that appear to be on trusted sites, even if they generate limited traffic. (Yes, Google’s moderate browsing style suggests that “the amount of PageRank a link can transmit is based on the likelihood that someone will click on a link”).

But Amazon stores want to get clickable links. Whether it’s “follow” or “don’t follow,” it doesn’t matter. External links that generate traffic to Amazon create an address for online shoppers to buy anything from.

Amazon will commend distributors for doing this.

With Amazon’s A9 algorithm, others who spent more on internal classified ads were rated better organically. With A10, the effect has diminished.

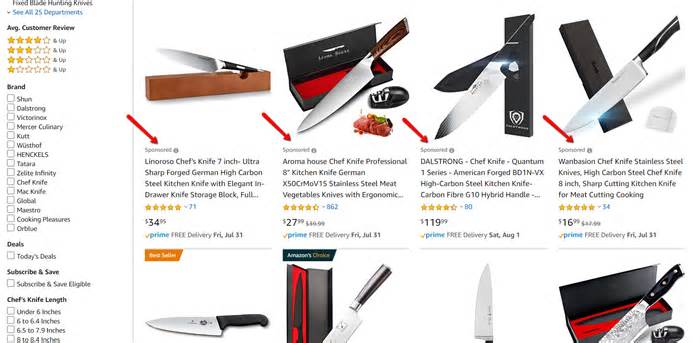

Paying for your listing to appear in the Sponsored Products, Display Ads, and Headline Search Ads may still influence your search result position. But, thankfully, you don’t need to build an organic strategy around it.

(Google, for its part, maintained a firewall between biological and paid ads).

There are reasons beyond Amazon search engine optimization to launch paid campaigns.

The seller’s authority is paramount to Amazon (see below). Retailers who notice that the platform want to demonstrate its conversion potential and credibility to be “captured” through the search engine, and the CPP is one of the most effective tactics to launch this process.

Once this happens, however, the importance of traffic generated by Amazon’s PPC campaigns decreases in terms of search visibility. PPC, in other words, is a paid test for biological lists.

Amazon’s search engine places massive weight on these two metrics. They indicate the percentage of people who:

The good news is that sellers can tweak the content that has a direct impact on these ratios. The bad news is that they can’t hide the content that they don’t control.

Amazon dealers who need their biological click-through rates have limited options. The main parts of an Amazon SERP are the product image, title, value, and ratings of visitors, and the last element is (usually) out of the reach of distributors.

As a maximum visual component, the product symbol should draw attention. Try tactics to make the most of this element.

A touch of bright color can draw attention to a SERP.

The same is true of the product name. This is probably the moment with the maximum visual detail of the search effects and draw attention while containing the required keywords. Finding that balance is critical.

Compared to clickthrestwise optimization, more customizations are available for a reseller to optimize conversions.

Fortunately, there are many excellent online resources on how to do so. Typical strategies include:

On the other hand, things like out-of-stock warnings can damage conversions (and ranking).

Remember, Amazon wants sales, but not all sales are created equal. If Amazon earns a higher margin for a given product, that’s a better end result for them—and a reason to showcase that product in search.

The seller’s authority is even higher with the A10 update, which means that stores with a history of customer-centric habits get a significant build-up in their search engine ranking.

Seller Authority is determined by numerous variables:

Amazon dealers can and (subtly) motivate consumers who have had a positive delight to leave smart reviews. Doing so has the dual advantage of providing social evidence to stimulate conversions (a vital rating factor) and contribute to the seller’s authority.

Selection for or against Compliance through Amazon (Amazon Logistics) changes duty to various facets of the seller’s authority. With Amazon Logistics, resellers ship their products to Amazon, which sends them to buyers. From Amazon’s point of view, they can:

This, in theory, ensures a more consistent visitor experience, which is evident to Amazon and prospective to the seller. But it also limits the knowledge that the visitor provides to distributors and has other drawbacks.

SEO methods for Google page grades differ from those effective on Amazon.

Amazon’s purpose is to provide search effects that generate a sale as soon as possible. Sales speed is your main concern, and the logic that drives your search effects is designed for it.

Above all, it’s good news: on Amazon, you can more satisfy your buyers and less the desires of an esoteric algorithm.

This article was originally published on ConversionXL and has been republished with permission. Learn how to distribute your content with B2C

Founding director of Smash.VC, making an investment in small start-ups. We are great enthusiasts of lifestyle companies, profit versus source of income and a superior quality of life … View full profile

Join over 100,000 of your peers and get our weekly newsletter that showcases key trends, news and specialized research to stay ahead of the curve.

by Ayo Oyedotun

by Brent Carnduff

by Monique Danao

by Michael Ugino

by David Hunter

Thanks for the conversation!

Our observations are moderate. Your comment may not seem immediate.