“R.itemList.length” “- this.config.text.ariaShown

“This.config.text.ariaFermé”

Confused by the existing monetary landscape? You’re notArray Unemployment is high, but in the face of this bad news, stocks have risen. Add to the combination an immediate accumulation in the rate of new COVID-19 infections and you will have a transparent market disconnection concept. At times like these, classical measures might not tell the whole story. You want other methods to perform the task.

Insider activity can act as a more reliable trading signal. Monitoring insiders, social agents guilty of managing their corporations to gain shareholder gains, is a common strategy for locating smart purchases. These executives are more guilty than their own advantage: they have to justify themselves to their board of directors and shareholders, and they have to show results. So when they start buying blocks of stock in their own business, it’s a signal that investors notice.

TipRanks Insiders’ Hot Stocks tool tracks those purchases and makes investors aware. We learned 3 moves that have recently been the subject of an “informative purchase” action through the company’s executives, to locate what makes them, well, hot. Here are the details.

Navient (NAVI)

First, Navient is a currency company that manages student loans. Navient claims more than 10 million individual loans, totaling more than $300 billion, and is one of the largest student loan managers in the United States, with a market percentage of 25%.

The crown epidemic has been the company; Economic closure and the resulting maximum unemployment have made borrowing a sometimes complicated activity in today’s climate. Navient has discovered something in the federal bankruptcy law, which prevents the cancellation of student loan debt.

This kept Navient in the dark, even as revenue and profits fell in the first quarter. The sequential drop was dramatic: revenues fell by 161%, while EPS fell by 23%. At the time quarter, the figures returned to more general levels. Revenues were positive at $125 million and profits exceeded forecasts and recorded 92 cents according to the share. The effects of the second quarter were resolved in a 2018 lawsuit alleging additional conduct. Navient accepted the corrective measures, but admitted no faults.

On a purely positive note, the company kept its dividend payments, even during the crisis. The quarterly dividend of 16 cents is 64 cents consistent with a consistent percentage and provides an impressive recoil of more than 8%, even with the value of the inventory depressed lately.

All of this deploys a corporate to deal with the existing storm. And the insiders have raised the stock. The largest recent purchase, through CEO John Remondi, totaled more than $390,000 for 50,000 shares. Other corporate managers made purchases ranging from $21,000 to $79,000. The purchasing activity has made navi NAVI’s insiders’ confidence measure very positive.

William Ryan of the Investment Corporation Compass Point is weighing on NAVI, pointing out the company’s strong quarter gains and plans for an upcoming $65 million percentage buyback. He writes: “We note that NAVI first suspended its forecasts after pronouncing the effects of the first quarter 20 due to uncertainty surrounding the COVID-19 pandemic. After granting only $238 million in personal loans in the quarter due to declining marketing efforts similar to Due to the volatility surrounding COVID-19, the company said it had resumed marketing this product. They plan to release about $2 billion in personal student loans in the part of the year… »

With a strong side ahead, Ryan offers NAVI a buyback and a target of $11. Its target implies a 28% increase. (To view Ryan’s review, click here)

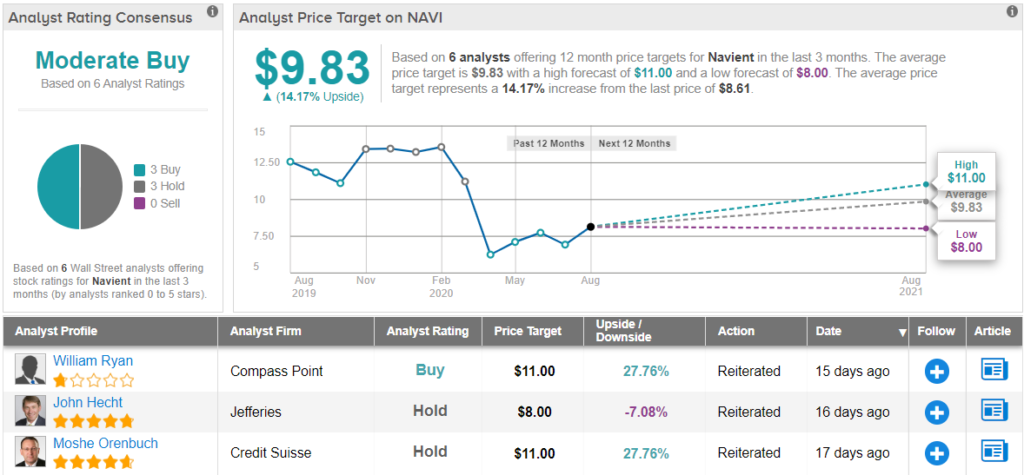

Analysts’ consensus on NAVI is a moderate acquisition, in an equivalent distribution of 3 to 3 between acquisition and retention notes. Inventories are priced at $8.60 and the average target of $9.83 suggests that inventory has room for a 14% expansion in the coming year. (See Navient action research in TipRanks)

Knowles Corporation (KN)

Next on our list is Knowles, a cellular audio provider. The company’s products come with microacoustic and audio processors for mobile devices. Knowles is well known for his contributions to cell phone hearing aids and handsets, however, its diversity also comes with portions and responses for autocellulars, other customer electronic devices, defense devices and medical systems.

Knowles’ income, the “crown part,” entered negative territory; however, the decline was, in some respects, expected. Overall, the company reported much higher revenues and profits at the time of the calendar year and, with the future, KN is expected to see third-quarter earnings increase from a five-cent loss to a 14-cent gain. This would bring the benefits back to the old criteria of the first part of the year.

Donald MacLeod, a member of knowles’ board of directors, made the only recent internal acquisition of the inventory, but that’s how important. He showed his confidence by buying a block of 10,000 shares, spending more than $150,000.

Five-star analyst Christopher Rolland of Susquehanna noted Knowle’s continued tension in the current quarter, but added: “… the effect appears to be of a short-term nature, affected by a $3 million impairment in Intelligent Audio shares (-200 bps) and decrease overall usage levels. Array Management is still on track to offer promised operating expense discounts from $42 million to $44 million since the December quarter … »

In line with this positive medium-term outlook, Rolland sets an acquisition note, with a target of $17 suggesting an 8.5% build-up for next year. (To view Rolland’s review, click here)

Knowles has 2 recent analyst reviews, and either is purchases, which unanimously agrees with the consensus on moderate purchases. Inventories are worth $15.66, while the $17 value target is Rolland’s previous value target. (See Knowles inventory market research at TipRanks)

Great Western Bancorp (GWB)

Last on today’s list is Great Western Bancorp, a corporate bank holding company in South Dakota. The company’s largest subsidiary, Great Western Bank, has more than 170 branches in nine states in the Great Plains, Rockies and Southwest regions. The company has assets of more than $12 billion and an 800 million market capitalization.

Great Western is the fifth largest agricultural lender in the United States, however, despite a strong market position, stocks fell during the crown crisis. A combination of points hit the bank hard, adding relief from “physical” activities on the ground, and the serious blow that farmers suffered during the economic recession. With the chains of origin interrupted, farmers had to destroy their products, wasting the source of income, and this sent comments to the entire monetary chain. Profits fell sharply in the first quarter and then again in the second quarter, without any of the forecasts, however, the bigger outlook for the third quarter suggests that the economic recovery is starting to feel for the company.

Trust is transparent from the purchasing activity of social agents and administrators. They have made purchases in recent days ranging from $25,000 to more than $190,000. Inventory blocks began in 2,000 inventories and increased. The largest purchase, through Douglas R. Bass, regional president and executive vice president, 15,000 inventories. Taken together, these purchases have given GWB a strongly positive domestic sentiment, far more than the average of comparable corporations in the monetary sector.

RBC 5-Star analyst Jon Arfstrom believes the bank is basically solid, writing: “In general, other basic trends will be stable, with a strong balance sheet expansion, modest but a tension in margins and moderate rates and expenses is expected… A more balanced view of perspectives. While we expect this to take a few quarters, we appreciate the focus on credits and improved threat formula through new CEO Mark Borrecco. In the end, the adjusted assignment is compared to the levels of your peers … »

Arfstrom values this inventory as a purchase, and its $17 value target indicates a prospective accrual of 29% for next year. (To view the Arfstrom review, click here)

Great Western percentages are maintained through analyst consensus, based on four ratings, 2 for acquisition and retention. Meanwhile, the average value target of $17.25 suggests a 19% increase over the existing percentage value of $1 four.51. (See Great Western Percentages Research in TipRanks)

To locate intelligent inventory trading concepts with exciting valuations, check out inventories to buy from TipRanks, a newly introduced tool that collects all tipRanks stock data.

Disclaimer: The reviews expressed in this article are only those of the featured analysts. The content is intended to be used for data purposes only. It is very important to do your own research before making any investments.