Beyond the decade, the cable industry has been affected through cable cut and the appearance of video transmission, which has led to a public decrease and income. This trend continued in 2024, since some media corporations approached the monetary situations that face the once lucrative cable industry.

According to Variety, which appeared Nielsen’s data, in 2024, there were only 3 cable networks that averaged more than one million audience during stellar schedule, Fox News, ESPN and MSNBC. One million audience in 2023. For the form of comparison, in 2014, when the cable cut in his childhood, 19 cable networks had exceeded the threshold of one million audiences.

With 2024 as an election year among other newsworthy topics, cable news networks have noticed large buildings in primetime viewing. None other than Fox News. Once again, Fox News is the top-rated cable network among all the channels. In 2024, the cable network averaged 2. 47 million viewership, a healthy year-over-year build of 30%. Only the 4 primary English-language broadcast networks attracted more primetime viewership.

MSNBC, which averaged 1. 26 million viewers, and CNN, which averaged 707,000 viewers, also saw year-over-year expansion of 4% and 20%, respectively. Unlike Fox News, both news networks experienced a significant loss of viewership after the election. Newsmax, a smaller news channel, also saw a sharp increase in viewership of 31% compared to 2023. While Nexstar-owned Newsnation remained strong compared to 2023 (-1%). In 2024, Fox News generated an average primetime audience greater than MSNBC, CNN, Newsmax, and Newsnation combined.

ESPN is the second-most-watched cable network of 2024 with an average of 1. 67 million primetime viewership, a slight drop (-2%) from 2023. ESPN’s audience delivery highlights the continued popularity of premium live sports with viewership. As the chain continues to load up its lineup of systems, such as the newly expanded 12-team school football playoffs (CFP). There’s anticipation that ESPN will launch a direct-to-consumer service someday in 2025.

Once again, viewership of the major large-scale entertainment networks continued its loose decline. For example, DTT attracted an average of 815,000 viewers in prime time, a minimum of -13% through 2023. After 40 seasons, the 2024-25 NBA season will be the last for games televised on TNT. The new media rights deal, finalized last July, added NBC/Peacock and Prime Video, while eliminating TNT.

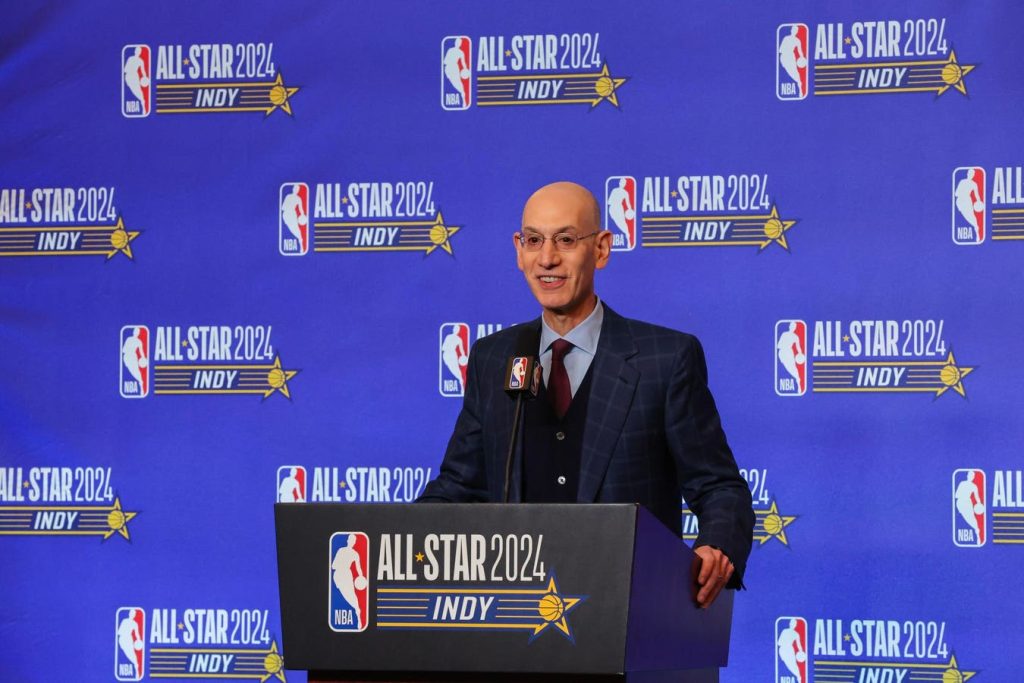

The NBA commissioner, Adam Silver, cited the decreasing trends of the cable as the cause of the Loss of Public of the NBA this season. In 2014, when TNT renewed a nine -year contract for the NBA games, the cable network averaged more than two million audience during the stellar schedule throughout the year.

USA Network, which has added more sports to its programming schedule, averaged 673,000 primetime viewers, a slight -2% loss from 2023. In 2014 however, USA cable network had averaged nearly 2.2 million viewers in primetime. In addition, WWE Raw, which ranks among USA’s top-rated programs in 2024, has moved to Netflix.

In 2024, a series of stressed networks of higher level had decreases of two digits from year to year at the upper listening audience, while the audience left the cable and / or looked more content on the transmission platforms. In 2024, HGTV, History, FX, AMC, FreeForm (formerly ABC Family), Food, Lifetime, A & E, TLC and Discovery, all recorded with two figures of falling one year in the other during stellar schedule. The ten networks were at least 700,000 hearings in 2024, opposed to more than one million audience in 2014.

Cable listening loss is recorded in Nielsen’s monthly Gauge report. In the November 2024 report, cable TV accounted for 25. 0% of the audience share among all viewers. For comparison, in November 2023, cable’s audience share was 28. 3%, compared to 31. 8. % in November 2022.

In 2024, the cable’s loss of profits affected the parent’s corporate results. In August, Warner Bros. Discovery and Paramount Global announced they would cut their cable networks. WBD announced a monetary write-down of $9. 12 billion, the next day, Paramount Global announced a monetary write-down of $5. 98 billion. These back-to-back ads were an indication of the decline of cable television.

The reaction of the media companies continued to the fall in the price of cable devices. In November, Comcast announced that the majority of their cable networks (except Bravo) would split. The media company announced the launch of a new independent company provisionally called Spinco to space its cable networks (and other virtual assets) as they lower price. WBD continued to announce that they would separate their cable television networks from their streaming and study televisions with the option of promoting them.

Furthermore, a recent trend in the negotiations of carriage renewal fees between prominent pay-tv distributors is dropping “long tail” cable networks that have been a part of the “cable bundle” but subscribers do not watch. In the past two years both Charter and DirecTV, two of the largest pay-tv distributors, have successfully negotiated with Disney that resulted in breaking up the “cable bundle” and adding the option of subscribing to an ad supported streaming tier.

Regional sports networks, once financially strong, have also been affected by eliminating the laces. In November, Diamond Sports Group, the largest RSN in the USA. , He left bankruptcy coverage after 20 months. The part of the restructuring included reduce the debt from approximately $ 9 billion to $ 200 million and convert the call of Bally Sports to Fanduel Sports Network. In addition, DSG has associated with Amazon to broadcast local sports in primary videos. In October, NBCU announced that the 4 RSN would be locally in Peacock.

The number of consumers canceling their cable TV subscriptions is accelerating. In 2022, 4. 9 million classic pay-TV providers cancelled their subscription, a figure that increased to 5. 4 million the following year. In the first three quarters of 2024 alone, an estimated 5. 7 million cable subscribers abandoned their pay-TV subscription. Today, most commercially distributed ad-supported cable networks are available in less than 50% of all TV homes.

According to Media Dynamics, for the 2024-25 upfront ad marketplace, cable primetime commitments from marketers totaled $9.065 billion, a drop-off of -4.8% compared to the 2023-24 upfront. Conversely, streaming video grew year-over-year by 35.3% totaling $11.1 billion. It marked the first time streaming surpassed cable (and broadcast) television in an upfront. Among the reasons for the decline in ad support are declining penetration, an aging audience and pricing.

The decline of cable as a display option is only slowing down, although it is accelerating. David Zaslav, CEO and chairman of Warner Bros. Discovery, said, “Just two years ago, the valuations and market situations that prevailed for classic media corporations were very different than they are today. “

For years the cable industry has benefitted from two strong revenue streams; subscriber fees and ad dollars. Both sources have been rapidly drying up as media companies continue to place a priority on their streaming properties. In addition, as more live sports and news migrate to digital platforms, it will result in a further audience declines. As this trend continues in the not-too-distant future, the only cable boxes will be found in the Museum of Broadcasting.

A community. Many voices. Create a slack count to keep your thoughts down.

Our network is about connecting other people through open and thoughtful conversations. We need our readers to make their revisions and exchange concepts and facts in one space.

In order to do so, please follow the posting rules in our site’s Terms of Service. We’ve summarized some of those key rules below. Simply put, keep it civil.

Your message will be rejected if we notice that it appears to contain:

User accounts will be blocked if we notice or believe that users are engaged in:

So, how can you be a power user?

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site’s Terms of Service.